Second homeowners may soon see council tax double in Dorset – but is that good for the county’s residents? Rachael Rowe reports

Coastal towns have hit the headlines in recent years with bans on second homes, especially in places where local key workers can no longer afford to live. Dorset has one of the highest rates of second homes in England, at one in every 34 homes, and the Government’s Levelling Up and Regeneration Bill presents an interesting opportunity for councils to impose a council tax premium on second homes; something Dorset Council is currently debating. But at a time when councillors have challenging decisions to make on budgets, is targeting second homes the right thing to do?

There’s a catch

The Levelling Up and Regeneration Bill was first presented to Parliament in May 2022. It is designed to devolve power and give local leaders and communities the tools they need to make better places and reduce inequalities. One of the components is the opportunity to implement a premium council tax payment on second homes; in effect a double council tax.

With 5,722 second homes in Dorset, the Council report that could potentially generate an additional £9.5 million in income for the county budget.

However, there’s a catch. Dorset Council has to give the government 12 months’ notice of their intentions, and the Bill still requires Royal Assent by April this year.

Dorset Councillor Peter Wharf was set to present the ‘Council tax premiums on second homes and empty properties’ report (read it here) at 23rd January’s Cabinet meeting. However, the Cabinet agreed that it should be discussed by as many councillors as possible before it is taken to a vote at Full Council. The report has now be added to the Place and Resources Overview Committee on Thursday 9 February to consider before providing recommendations to Cabinet on Tuesday 28 February. If agreed, it will then go to the Full Council meeting in March.

West Dorset MP Chris Loder has spoken in support of the proposal, saying it would ‘make it fairer for local people. Firstly, it will provide much needed income for the council for a fairer tax policy. And secondly, it will encourage property owners to think again before leaving their houses empty at a time when there are hard working local people struggling to find a home.

‘I have always maintained that to sustain our community infrastructure, we need to incentivise and support local people to stay and live in our communities.’

Behind the scenes at Dorset Council, any proposal of this nature requires discussion and agreement before notifying the Government of their intentions. And of course, it depends on the Bill being agreed upon.

It all feels a bit chicken and egg – but what benefits, if any, will this premium bring to Dorset? I spoke to Peter Wharf.

What is a second home?

Some people will naturally wonder whether the property they own and rent to key workers will also be eligible for this stealth tax, so I asked Peter to clarify what the council means by the phrase.

‘A second home is a second home. If someone has more than one property, then it is a second home. We have a list of homes that are potentially eligible for council tax; however, if someone is letting the property permanently, for example, that is not a second home.

‘We’re talking about the furnished properties that are left empty or used as holiday lets and rented on sites like Airbnb.’

Dorset Council has previously levied higher rates on empty properties. How has that worked?

‘That’s quite difficult to determine. It is difficult to see and assess all the properties, obviously. However, other councillors tell me anecdotally that it has sped up plans and building in some areas.’

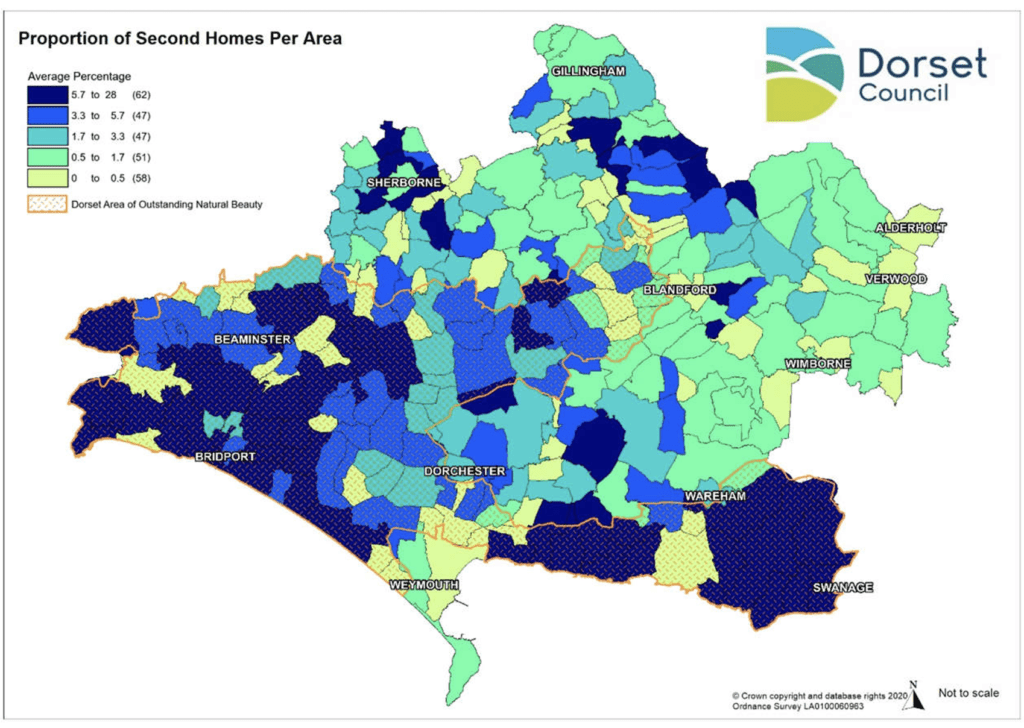

According to the Council’s background paper on second homes in 2021, Dorset’s Coast, the AONB that runs to the north of the county and much of West Dorset have a particularly high proportion of second homes (see image right). There’s a lot of negative publicity about second homeowners, but does Peter think they bring any benefit to a local economy?

‘Well, there are benefits and disbenefits. One disadvantage is the schools don’t get enough pupils, and there is a lack of community in some areas. However, there is a counterargument.

People come here and eat out in the restaurants, visit the beaches and go to the attractions. So they may add to the economy but detract from communities as they only live here sometimes.’

While the new proposal to double council tax may potentially help with house prices and the housing demand, I’m wondering what else councils can do to stop communities from becoming overwhelmed with second homes. Peter has a view:

‘There is very little we can do as it’s all about a free housing market and what people choose to do. However, it is possible to get an agreement that new housing should not be used for second homes. What we don’t want to see is a situation where second home owners are made to feel very unwelcome in Dorset. We don’t want that here.’

Airbnb wins

So how could doubling the council tax affect tourism?

‘It is possible that second home owners won’t come here if we charge a premium. There is a possibility some will sell up. We also don’t know whether the £9.5 million quoted in the report will be realised because some people may sell up. I have spoken to some second homeowners who tell me they can get far more with Airbnb-ing their property than they can renting. It isn’t easy to generalise as people will choose what they want to do.

‘We are presenting this proposal now because it is an opportunity to regenerate communities in Dorset. It will go to the Place and Resources Overview committee, the Cabinet, and then the full Council. The public has an opportunity to attend.’

Second homes are like Marmite in rural and coastal communities and are guaranteed to stir up a debate. But, like them or loathe them, all councils are under pressure to find ways of funding core services.

Details of the process and discussion on this proposal are on the Dorset Council website. If you have strong views, contact your local Councillor.

• Dorset Council has 82 councillors, of whom 24 have disclosed second properties and are therefore excluded from this vote