While ordinary people suffer the impacts of a cost-of-living crisis, Rishi Sunak’s Tories appear to be busy preparing the ground for another one by lifting the cap on bankers’ bonuses.

They were capped at 100 per cent of bankers’ salaries in 2014 as a part of efforts to avoid a financial crisis like the one in 2008. In some cases, bonuses of more than 100 per cent can be awarded to top performers and more senior investment banking roles. Finance bosses have long complained about the rules, however, saying that they have had the unintended consequences of pushing up bankers’ fixed pay, and giving them less wriggle room to vary pay due to material poor performance or misconduct.

However, as an ex-banker himself, the prime minister will be fully aware of the behaviours that an uncapped reward scheme will drive. While the general idea of rewarding employees who have contributed significantly to an increase in profits for the part of the business they work in seems uncontentious, the sheer scale of the bonuses available in an uncapped system has proved to encourage the kind of excessive, greed-driven risk-taking in the financial services industry that led to the financial crash in 2008 – a crash that is still being paid for by the same ordinary working people who now find themselves in the grip of the cost-of-living crisis.

Meanwhile, as Sunak and his Cabinet appear set to line the pockets of the bankers again, there are no proposals to stop banks from showering themselves with the profits from the interest rates rising; the same rates that are crippling workers and businesses alike.

In whose interests does this government continue to act?

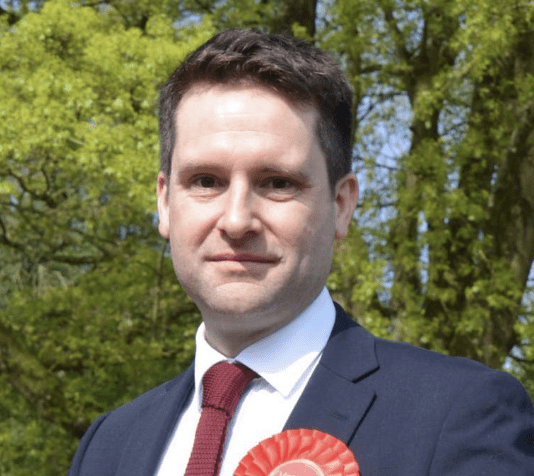

- Pat Osborne

North Dorset Labour